Driving execution of our strategy

Radio Innovation is shaping the industry landscape for extreme coverage in rural areas, creating the world’s most powerful innovation for high gain and full coverage for digital inclusion. We remain focused on three priorities:

- converting our sales pipeline into net sales

- enhancing partnerships with distributors, strategic partners and CSPs

- and actively focusing on R&D for cost reduction and new 5/6G product roadmap

Looking ahead

- For the second half of 2023, we expect similar market mix and trends as in Q1 and Q2. However, we are more confident today about converting our sales pipeline in the later part of 2023. Our outgoing RFQs have an order booking value of more than 80 million SEK, and the goal is for these to result in closures (booked deals) in Q4 2023.

- As we look ahead, a fundamental driver of network capex investments from CSP’s have almost stopped due to uncertainties, however, many CSP now also face challenges from Government regulators to increase coverage in rural areas due to the digital divide. Here, Radio Innovation has a great opportunity to achieve breakthrough on our primary markets, such as LATAM, South Africa and MEA.

- Adjustments of the supply chain will continue primary factors are once again CAPEX savings from CSPs, shortage, and the overall economic uncertainty in the world.

Finally, our technology leadership, product roadmap and the potential sales pipeline, position us well for the future. We are navigating the current environment with discipline and focus, executing our strategy which was presented at our Annual Shareholder meeting in June of this year.

Half year highlights – performance below expectations

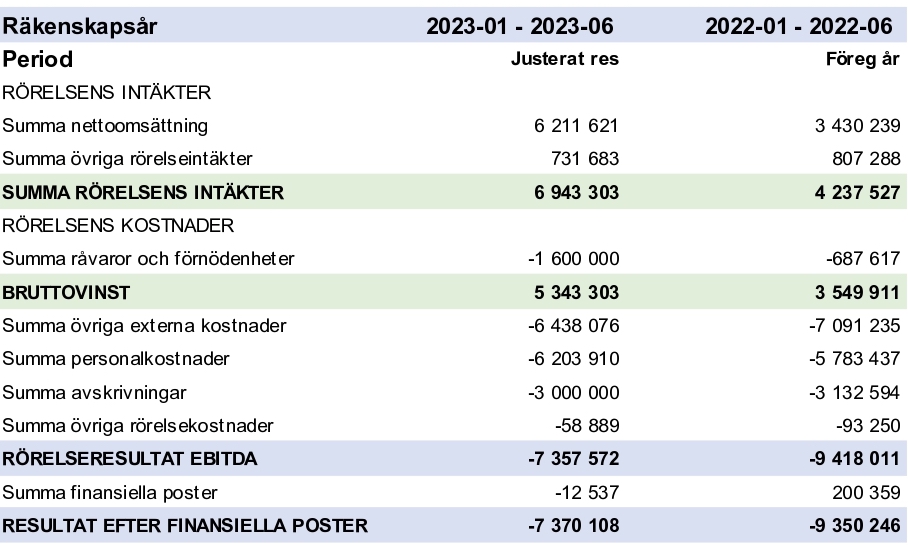

– Sales turnover of 6.9 MSEK, (compared to 3.4 MSEK 2022)

The difference in budgeted sales compared to the outcome during the first six months of the year is due to several reasons. A component shortage has affected operators, which has led to a temporary change of focus among them. In addition, the ongoing general uncertainty around the world and not least in Europe has led to CAPEX- and OPEX savings.

Our OPEX, which has always been higher in the first half of the financial year, is in line with the previous year 2023 (-12.6 MSEK) compared to 2022 (-12.9 MSEK). However, our goal is to end the year at approximately 1.6 million per month.

– We are keeping our Gross margin at around 40% (42.2%) even though the price of high-grade aluminum has increased with more than 28% for the last 2 years.

– EBITA -7.3 MSEK compared to -9,4 MSEK 2022

Further news for highlights:

- Regarding the convertible loan, which was implemented in December 2022 and with redemption in December 2023, all major shareholders have now decided to convert their debts into shares.

- In accordance with the conditions presented and the decision taken at the last General Meeting, the company will also buy back the stock options and convert them into shares.

Thank you for your continued trust and support.